Venture Capital and the New Manhattan Project

By Peter A. Kirby

It appears that venture capital is yet another way that the New Manhattan Project has been propelled over the years. It appears that venture capital firms and the companies that they fund have contributed significantly to the biggest scientific effort in history. Here we detail the story of venture capital from its origins in the New England Council, to the subsequent American Research and Development Corporation, to Fairchild Semiconductor and the move to Silicon Valley. We will also examine particular venture capital firms with the most serious implications for the New Manhattan Project such as Draper, Gaither and Anderson, Venrock, and In-Q-Tel.

If you haven’t heard, the New Manhattan Project, which has apparently been partially funded by venture capital, is an ongoing global weather modification project involving the annual spraying of tens of thousands of megatons of toxic waste over unsuspecting Americans. For more information, please refer to my book Chemtrails Exposed: A New Manhattan Project - the revised and updated Skyhorse Publishing edition is coming soon!

VIDEO:

https://rumble.com/v6ydeko-venture-capital-and-the-new-manhattan-project.html?e9s=src_v1_ucp_a

Most people have heard of venture capital as a way to fund new, innovative technology companies. They heard right. Venture capital firms enable a series of successively larger funding rounds conducted in hopes that the company receiving the venture capital will eventually go public on a major stock exchange and make lots of money for everybody involved. Although most of these ventures fail, one big winner can make up for many losers. Venture capital is a way to invest a relatively small amount of money and see a huge profit in a relatively short period of time. It’s a way to get in on the ground floors of the next big thing. Although it can be used to fund just about any type of business, venture capital is most commonly used to fund technology companies due to that sector’s often favorable risk/reward ratios.

Venture capital is presented here as having propelled the super high-tech New Manhattan Project (NMP) over the decades, but it’s not the only thing that has accomplished this. As detailed in the ‘Funding’ chapter of my book, the evidence indicates that military budgets (both black and otherwise), missing money, the Research Corporation for Science Advancement, as well as the CIA’s global narcotics racket have all been instrumental in propelling development of the NMP. Much information about all of the ways that the NMP has apparently been funded over the years can be found in my book, but this paper is about venture capital, a topic that is not found in my book. So let’s start at the beginning…

Northeastern origins, Georges Doriot and the rise of ARD

Although many wealthy people, organizations and governments have been funding tiny enterprises in the hopes of large returns for a very long time, the origins of today’s modern venture capital industry are found in something called the New England Council, which was formed in 1925 as a think tank designed to address regional economic issues.

In 1939, as suggested by Massachusetts Institute of Technology President Karl Compton (1887-1954), the New England Council formed their New Products Committee. Among the distinguished members of this committee were Compton, Vermont Senator and head of the Boston Federal Reserve Bank Ralph E. Flanders (1880-1970) and Georges Doriot (1899-1987). Doriot headed up a subcommittee called ‘Development Procedures and Venture Capital.’ It was Doriot that became the driving force behind the birth of the most successful, early modern venture capital firm.

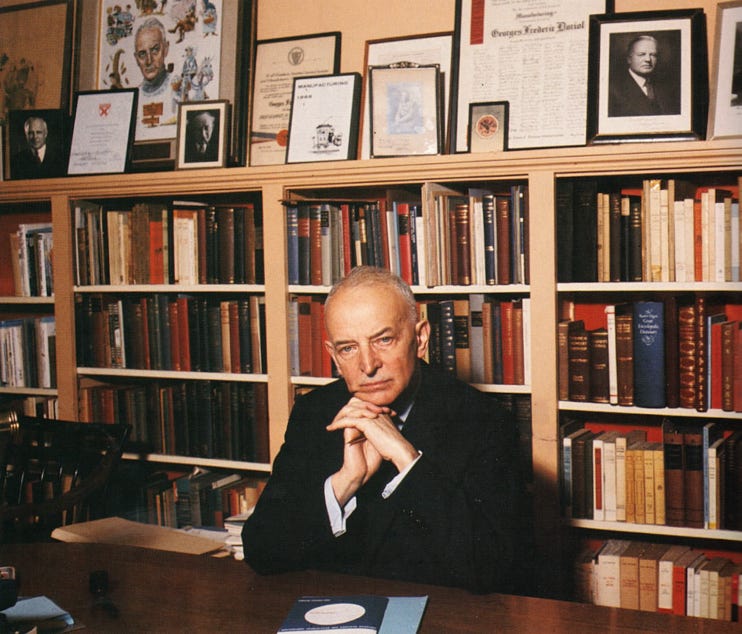

Georges Doriot

Doriot immigrated to America from France in 1921. After an abortive enrollment at the Massachusetts Institute of Technology (MIT), Doriot enrolled at Harvard Business School (HBS) in the spring of 1921. Doriot later went on to join the HBS faculty in 1926 and become a professor in 1929.

Doriot became a U.S. citizen in 1940 and, being that World War II was going on at the time, he joined the Army Quartermaster Corps where he worked in logistics management and rose to the rank of brigadier general. Although his time in the military delayed his foray into venture capital, it gave him experience and connections that would go on to greatly enhance his later career. Spencer Ante, the author of Creative Capital: Georges Doriot and the Birth of Venture Capital writes:

“It was through World War II that [Doriot] underwent the most significant metamorphosis of his life, transforming himself from a professor of business into a world-class builder of innovative new enterprises. When Doriot became head of the Military Planning Division in the Officer of the Quartermaster General, he began running, in a sense, his first venture capital operation. The purpose of his division was to identify the unmet needs of soldiers and oversee the development of new products to fill those needs. In order to pull off this miracle, Doriot perfected the art of finding the right people for the right technical challenge, and then inspiring them to invent the future.”

He was so good at what he did that one could say that Doriot is a founder of the military/industrial complex because in many instances he effectively streamlined the ways in which contractors interacted with the military, leading to new efficiencies in materiel production and distribution. He also introduced a host of entirely new strategic products such as insect repellant and backpacks. During the war Doriot was essentially running a multi-billion dollar operation… and that’s back when a billion dollars was actually worth something!

The origins of Doriot’s military career can be traced to 1939 when the founder of the primary predecessor to today’s Central Intelligence Agency, William ‘Wild Bill’ Donovan (1883-1959) arranged a meeting between Doriot and President Franklin D. Roosevelt. Donovan had first become aware of Doriot through Harvard Business School. During the war Doriot served on one committee with the aforementioned Karl Compton as well as with Harvard University President James Conant (1893-1978), two of Doriot’s closest colleagues.

Following the war, Compton and the New England Council quickly returned to their plans. After bending a few laws to make it happen, in 1946 members of their aforementioned New Products Committee raised $3.5M by selling about 140,000 shares of American Research and Development Corporation stock at $25 each. MIT was one of the original shareholders. On June 6, 1949 the American Research and Development Corporation (ARD) was incorporated under Massachusetts law to, as Doriot wrote in their first report, “…aid in the development of new or existing businesses into companies of stature and importance.” Doriot was named ARD’s first Chairman of the Board. Once out of the military, Doriot went back to being a professor at HBS and began running ARD as well. Although decommissioned, Doriot continued to serve as an active participant at the highest levels of the U.S. military. In one of these capacities, he served as an advisor to Vannevar Bush (1890-1974), who oversaw the original Manhattan Project.

Two of ARD’s earliest investments were in atomic physics. One of these was $200,000, or an 80 percent stake in the High Voltage Engineering Corporation. High Voltage Engineering was an MIT spin-off co-founded by John Trump (1907-1985), the Donald’s uncle. As readers of my work know, MIT professor John Trump was the scientist tasked with deciphering Nikola Tesla’s posthumously confiscated documents. High Voltage Engineering produced generators and nuclear particle accelerators. Another early ARD investment was $150,000 to another company formed by MIT brainiacs called Tracerlab. They sold radioactive isotopes and machines that detect radiation. ARD, High Voltage Engineering and Tracerlab soon had interlocking directors. High Voltage Engineering and Tracerlab went on to become very successful.

A later ARD investment, Digital Equipment Corporation (DEC) went on to become ARD’s biggest hit. DEC eventually became the largest employer in Massachusetts and America’s second largest computer manufacturer behind IBM. DEC was founded by Kenneth H. Olsen and Harlan Anderson, two scientists who had worked on the SAGE missile defense system. The SAGE system was handed off to the MITRE Corporation in 1958 and the evidence indicates that it is this SAGE system which has gone on to form the core of the operations that result in today’s domestic spraying of tens of thousands of megatons of toxic waste from large jet aircraft. For more about the SAGE system and the MITRE Corporation, please review my 2024 video “Why Is Nobody Else Talking About the MITRE Corporation?”

As part of a merger deal with an affiliate, ARD acquired about $1.6 million in Raytheon common and preferred stock. For more about Raytheon’s extensive implications here, please see my 2022 video “Raytheon and the New Manhattan Project.”

Interestingly, in 1959 ARD made a $190,000 investment in Zapata Off-Shore Company; a company with future president George H. W. Bush at the helm. For more about the Bush family’s extensive implications in the New Manhattan Project, please refer to my 2024 video “CHEMTRAILS: A Bush Family Business?”

In 1959 ARD invested $750,000 in Textron Electronics, a spin-off from Textron, Incorporated. After some extensive problems with the SEC in the 1960s, ARD merged with Textron in 1972. For more about Textron’s extensive implications here, please refer to the author’s 2020 article “Textron and the New Manhattan Project.” In 1985 Textron sold their ARD division to a buyer, the identity of whom was never disclosed publicly, but two people directly involved in the deal are on the record as saying that the buyer was, “an heir of the Mellon family based in Vermont.”

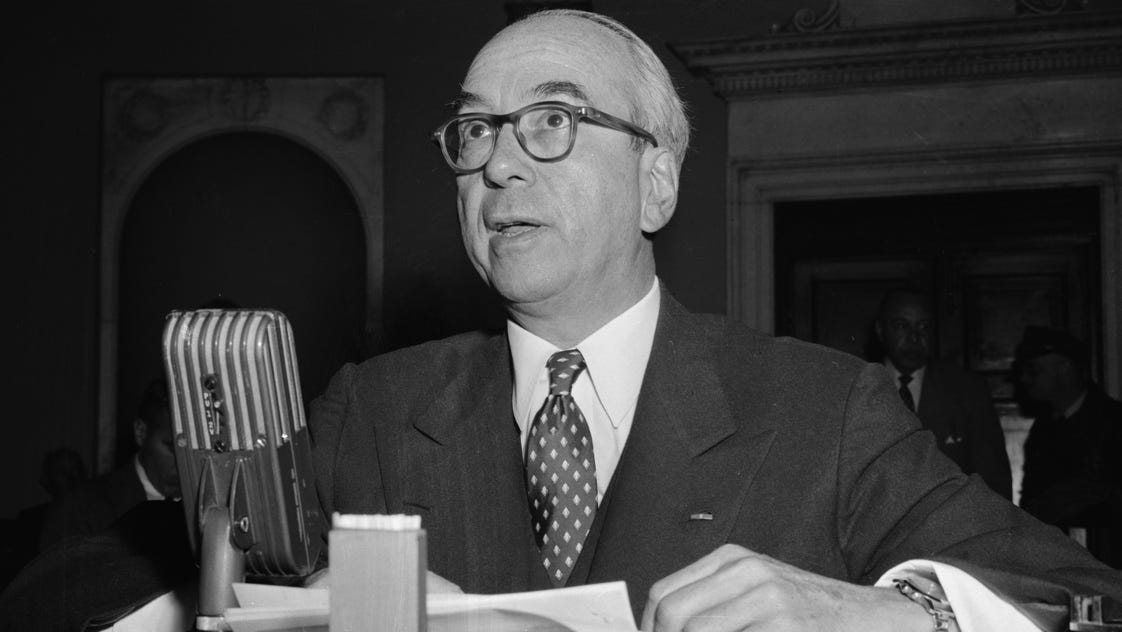

The last compelling connection between ARD and the New Manhattan Project is found in the person of Lewis L. Strauss (1896-1974), former head of the Atomic Energy Commission. The Atomic Energy Commission was what became of the original Manhattan Project and what turned into today’s Department of Energy. All three of these organizations have profound implications for today’s NMP. Becoming acquainted with each other through the banking house of Kuhn Loeb, Doriot and Strauss were the best of friends for thirty years. Doriot considered Strauss and his wife Alice family and Strauss was Doriot’s best man at his wedding.

Lewis L. Strauss

The westward expansion

Today, as many people already understand, the vast majority of venture capital activity takes place in Silicon Valley, California on the San Francisco Peninsula. Most of the top venture capital firms are located there. Silicon Valley is one of the largest global hubs of high technology and its early growth had almost everything to do with a company called Fairchild Semiconductor. Fairchild was made possible by venture capital funding and, to a large extent, the venture capital business in Silicon Valley grew out of Fairchild. Christophe Lécuyer and David C. Brock in their book Makers of the Microchip: A Documentary History of Fairchild Semiconductor write:

“It was this group of firms - Intel and the other start-ups established in Silicon Valley in the late 1960s and the early 1970s - that, along with Motorola and Texas Instruments, digitalized the human-built world. The critical technology that they developed was MOS integrated circuits, the variant of the planar integrated circuits originally developed at Fairchild Semiconductor.”

Fairchild was established in 1957 to provide the U.S. military with the microchips they needed for military computing and avionics applications. These were products essential for electronic systems used in airplanes and missiles for control, guidance and communications. The New Manhattan Project is a military project and these types of microchips produced by Fairchild would be essential for its development.

Fortunately for Fairchild, in October of 1957 the Russians launched Sputnik and the U.S. government immediately began spending outrageous amounts of money on the newly initiated space race. Fairchild’s products were, from the beginning, in tremendous demand and their revenues and employee counts soon skyrocketed. Fairchild founder Jay Last writes:

“There was a tremendous military effort in this country directed toward the development of miniaturized airborne electronic systems. Our small, lightweight, high-performance transistors proved to be ideal for these needs. Over the next few years, our accelerating military sales enabled us to build up the volume needed to lower our production costs, thereby hastening our ability to sell our products into commercial and consumer markets.”

Fairchild Semiconductor and their subsidiary Fairchild Controls worked on many classified projects. A man named Robert Norman (1938-2004) worked at Fairchild and also worked on Vice Admiral William Raborn’s Polaris missiles. As detailed in the author’s book, Vice Admiral Raborn (1905-1990) appears to have been central to the development of the New Manhattan Project. Another Fairchild employee named Lionel Kattner had previously been an original Manhattan Project scientist.

Since their heyday, Fairchild has been passed around quite a bit. Oil field services giant Schlumberger purchased Fairchild Semiconductor, along with their parent company Fairchild Camera and Instrument in 1979. Then National Semiconductor acquired Fairchild Semiconductor in 1987. In 1997 Fairchild Semi was spun-off from National Semi as an independent company. Then, lastly in 2016 Fairchild Semi was acquired once more by ON Semiconductor.

Draper, Gaither and Anderson

We are interested here in the Silicon Valley venture capital firm of Draper, Gaither and Anderson primarily because of the involvement of Horace Rowan Gaither (1909-1961). William H. Draper, Jr.’s involvement is significant as well due to his extensive, highest-level military contacts; Draper was an Army major general as well as the U.S. ambassador to NATO. But the evidence indicates that Gaither in particular had more extensive and specific ties to the New Manhattan Project.

Horace Rowan Gaither

Gaither was an assistant director of the wartime MIT Radiation Laboratory which produced early versions of technologies that, the evidence indicates, went on to be improved and integrated into the New Manhattan Project such as the remote control of aircraft as well as over-the-horizon radar. Gaither also was instrumental in the formation of the RAND Corporation, which appears to be central to the early production of the NMP. Not only that, but Gaither was one of the original trustees of the aforementioned MITRE Corporation. For more about Gaither, please refer to the author’s 2020 article “The RAND Corporation and the New Manhattan Project.”

Since the formation of Draper, Gaither and Anderson in 1959, there has been a whole slew of related venture capital firms, many of them founded by other members of the Draper family. One of these firms is Sutter Hill Ventures, but beyond that, unraveling this ball of yarn and figuring on any potential involvement in the development of the NMP here is going to take significantly more research. Please stay tuned.

Venrock

Although many other famous industrialists have started venture capital firms, the Rockefeller family’s Venrock is of particular concern to our investigation. It is of particular concern due to the Rockefeller family’s numerous and extensive implications in the NMP. The many ways in which the Rockefeller family is implicated in this thing are far too much to go over here. Thankfully I did a piece about it last year. Please check out my video “Rockefellers Covering the Earth with Chemtrails?” if you would like to explore that particular rabbit hole. Here we will focus only on the family venture capital firm Venrock.

Venrock was established in 1969 in order to accommodate the venture capital activities of Laurance Rockefeller (1910-2004). Venrock opened offices in Silicon Valley in 1984. In his book VC: An American History Tom Nichols writes, “Venrock was colocated with the family office at 30 Rockefeller Plaza in New York where a staff of around 150 people engaged in three forms of investing: standard (that is, in equities and bonds), real estate, and venture capital.”

“Laurance Rockefeller had initially brought family members into investments on an as-needed basis, but Venrock was designed to systematize matters and be a single entity that would act as the core of the Rockefeller family’s activities in venture finance.”

Laurance Rockefeller

Going back to before World War II, Laurance Rockefeller was deeply embedded in the American aerospace industry. During WWII Rockefeller assisted the Bureau of Aeronautics in the administration of aircraft production. After the war Venrock was initially founded as Rockefeller Brothers, Inc. The firm invested in companies producing jets, helicopters, rockets, radars, aviation electronics and nuclear research: all areas with high relevance to the NMP. Throughout all of this Rockefeller worked closely with an individual heavily implicated in the NMP named Theodore ‘Teddy’ Walkowicz. The aforementioned Lewis Strauss was a member of Rockefeller’s staff. More details are in my book.

In-Q-tel

Lastly, we are interested in the venture capital firm known as In-Q-Tel because they are a branch of the Central Intelligence Agency (CIA). The CIA has only the most profound implications for the New Manhattan Project. For more about the CIA’s links to the NMP, please see the video I did last year titled “CHEMTRAILS Brought to You by the CIA?”

Under Director of Central Intelligence George Tenet and led by former Lockheed Martin CEO Norman Augustine, in 1999 In-Q-Tel incorporated in Delaware as a privately held enterprise whose only customer is the CIA. According to their website they are currently classified as a 501(c)3 not-for-profit organization. They’re a CIA cutout, basically. The CIA funds In-Q-Tel with tens of millions of dollars every year. They have offices on Sand Hill Road in Silicon Valley.

In-Q-Tel invests in small companies developing technologies desired by the intelligence community. In-Q-Tel also requires that the technologies in which they invest have viable commercial applications.

While In-Q-Tel itself is more focussed on achieving objectives rather than making money, In-Q-Tel has tremendous influence within the venture capital ecosphere and being an In-Q-Tel portfolio company affords an enterprise great entree not only into the intelligence community, but also into the rest of the federal government. In-Q-Tel portfolio companies gain access to many important resources such as expert help in the fields of accounting, law, public relations, personnel, marketing and more. Once a company is blessed with In-Q-Tel’s imprimatur, many other prominent venture capital firms as well as banks, large corporations and other wealthy entities commonly rush forward to shower the lucky enterprise with cash.

Have In-Q-Tel and the other venture capital companies mentioned here been funding companies that produce technologies used in the New Manhattan Project? The odds are high.

Conclusions

Beginning in the northeast, then flourishing out west, venture capital’s path mirrors that of the NMP itself. For more about the NMP side of that equation, please see my video “The Post War Development of the New Manhattan Project.” But your author is finding that there is a bigger story here; bigger than just venture capital and the NMP. That bigger story is about how the development of the super-high tech New Manhattan Project impacted the growth of Silicon Valley writ large. After all, the NMP is the biggest scientific effort in history, so it is reasonable to assume that it has had a tremendous impact. The evidence indicates that the rise of Silicon Valley is inextricably intertwined with the later stages of the New Manhattan Project’s development. It’s going to take some time to figure all of this out, but please keep an eye out for a future paper and video titled “Silicon Valley and the New Manhattan Project.” Thank you.

I will be speaking before the Liberty Forum of Silicon Valley on the 9th of September at the IFES Portuguese Hall at 432 Stierlin Road in Mountain View, CA. The doors open at 6:15 and the show starts at 7:00pm. Admission is free for Liberty Forum members, but it’s $25 for non-members who pay in advance and $30 at the door.

References

New England Council: Its Beginnings, Its Work, and Its Future (1925-1952) a booklet by Walter H. Wheeler, Jr. published by The Newcomen Society 1952

Senator from Vermont a book by Ralph E. Flanders published by Little, Brown and Company 1961

Creative Capital: Georges Doriot and the Birth of Venture Capital a book by Spencer E. Ante published by Harvard Business Press 2008

VC: An American History a book by Tom Nicholas, published by the Harvard University Press 2019

Makers of the Microchip: A Documentary History of Fairchild Semiconductor a book by Christophe Lécuyer and David C. Brock published by the MIT Press 2010

The Power Law: Venture Capital and the Making of the New Future a book by Sebastian Mallaby published by Penguin Press 2022

Government Venture Capital: A Case Study of the In-Q-Tel Model a book by Michael E. Belko published by the Department of the Air Force Air University, Air Force Institute of Technology 2004

NuclearPlanet.com

ZeroGeoengineering.com

Americans4ACleanAtmosphere.com

GlobalSkyWatch.com

ChemtrailsNews.com

ChemtrailsExposed.com

NoGeoingegneria.com

ChemSky.org

ChemtrailsProjectUK.com

Peter A. Kirby is a San Rafael, CA researcher, author and activist. Please pre-order the Skyhorse Publishing edition of his book Chemtrails Exposed: A New Manhattan Project coming Jan. 20, 2026. Also please join his email list at his website peterakirby.com